Subscribe

Subscribe

Subscribe to FX Markets

Choose the subscription package best suited to your needs from the options below.

Individual

For single users. Access to all content across the entire site.

£2935

- Online news and analysis

- Exclusive, subscriber-only newsletters

- FX Markets app

- 20% discount on all FX Markets events

- Discount on Risk Books

Data

Access to the Counterparty Radar data tool and all FX Markets content

£3995

- Counterparty Radar interactive tool

- Minimum of 5 users

- Unique commentary articles from fund filings data

- All online content

- A dedicated account handler

Corporate

Multi-user access, flexible to suit your needs.

- All of the online content

- Access for multiple users

- A dedicated Account Handler

- Account Analytics

“Since the brand launched in 1990, I have watched the magazine, and latterly its online version, grow, flourish and develop into an extremely useful source of factual background for those of us involved in the FX market. I see FX Markets as a great friend to the industry.”

Founder and CEO, HP Economics

“The content is excellent – the editorial team know the market very well.”

CEO of a major Professional Services firm

“FX Markets has complete coverage. Whether that be the latest developments in eFX, what the ECN’s and individual banks and brokers are up to, or regulatory matters. And of course the articles concerning new appointments are always mandatory reading!”

Founder and CEO, HP Economics

What do we cover?

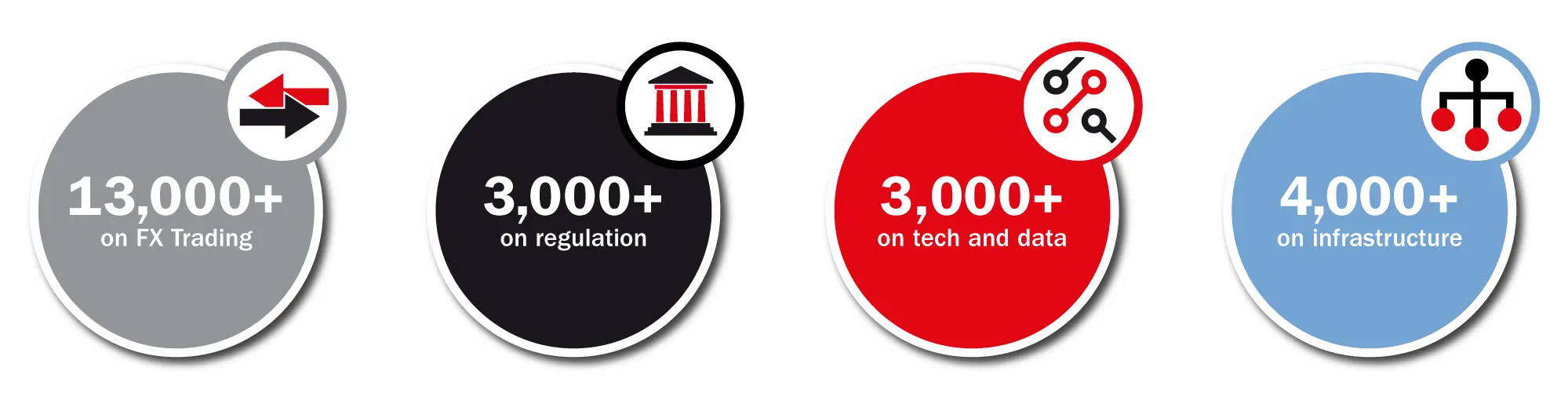

We have an archive of 22,000+ articles across 5 distinct topic areas – trading, infrastructure, tech and data, and regulation.

We provide data insight through our interactive tool - Counterparty Radar. This is based on regulatory report filings on over 23,000 US mutual funds.

Our editorial team specialise in 5 distinct topic areas – trading, infrastructure, tech and data, and regulation.

Already signed up

HSBC is a financial services organisation that serves more than 40 million customers, ranging from individual savers and investors to some of the world’s biggest companies and governments. Its network covers 64 countries and territories, and its expertise, capabilities, breadth and perspectives open up a world of opportunity for its customers. HSBC is listed on the London, Hong Kong, New York, Paris and Bermuda stock exchanges.

About Murex

Murex provides enterprise-wide, cross-asset financial technology solutions to sell-side and buy-side capital markets players. With more than 60,000 daily users in 65 countries, its cross-function platform, MX.3, supports trading, treasury, risk, post-trade operations, as well as end-to-end investment management operations for private and public assets. This helps clients better meet regulatory requirements, manage enterprise-wide risk, and control IT costs. Learn more at www.murex.com.

IHS Markit is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80% of the Fortune Global 500, and the world's leading financial institutions.

BNY Mellon is a global investments company dedicated to helping its clients manage and service their financial assets throughout the investment lifecycle. Providing financial services for institutions, corporations or individual investors, BNY Mellon delivers informed investment and wealth management and investment services in 35 countries.

Credit Suisse AG is one of the world's leading financial services providers and is part of the Credit Suisse group of companies. As an integrated bank, Credit Suisse is able to offer clients its expertise in the areas of private banking, investment banking and asset management from a single source. Credit Suisse provides specialist advisory services, comprehensive solutions and innovative products to companies, institutional clients and high net worth private clients worldwide, and also to retail clients in Switzerland. Credit Suisse is headquartered in Zurich and operates in over 50 countries worldwide. The registered shares (CSGN) of Credit Suisse's parent company, Credit Suisse Group AG, are listed in Switzerland and, in the form of American Depositary Shares (CS), in New York.

Further information about Credit Suisse can be found at www.credit-suisse.com

ミューレックスは30年以上にわたり、資本市場参加者向けにクロスアセット金融テクノロジーソリューションを提供しております。クロスファンクションプラットフォームのMX.3は、トレーディング、トレジャリー、リスク管理および取引時及び以降の業務処理を支え、お客様の規制要件への適切な対応、企業全体のリスク管理と、ITコストコントロールを可能にします。 ミューレックスは、証券会社様、銀行様、アセット・マネージメント様、エネルギーおよびコモディティ事業法人様等、世界中の60か国で300を超える導入実績、50,000以上のユーザー様をサポートしております。ミューレックスは17カ国の拠点に2,000人以上の従業員を擁する独立系企業です。最先端技術、優れた顧客サービス、そしてユニークな製品革新を提供することに尽力しています。

FAQs

What are my payment options?

You can pay for your subscription online by credit card (Visa, MasterCard, American Express). You will receive immediate access using credit card payments.

You can request an invoice be sent to your company by contacting our customer services team via this form.

We also accept BACS transfer – contact our customer services team via this form for more details.

Online access will only be granted upon receipt of payment. Please note that your subscription (both print and online) will not commence until full payment has been received.

I want more than one subscription - what are my options?

You can set up a Corporate Subscription for multiple people. You can find out more here, or you can email us at info@fx-markets.com

Alternatively, speak to a member of the team today:

UK & Europe: +44 (0) 20 7316 9300

Americas: +1 646 736 1850

Asia & ROW: +852 3411 4828

Can I demo FX Markets before subscribing?

Yes, you can request a free demo here.

What are your terms and conditions?

You can read our full terms and conditions here.